Oil prices above $60 bbl. What’s next?

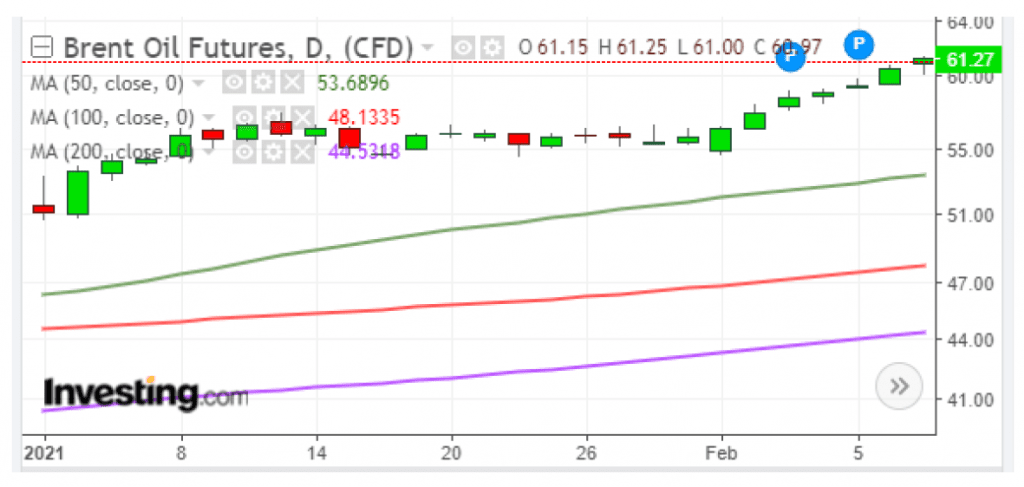

From the start of the year, oil prices have gained close to 20%. The past seven trading days have seen a continuous rise in oil prices from $55.81 bbl to over $60 bbl. What has been the cause for this? And what lies ahead? We will attempt to summarize this in the next few paragraphs.

Why the rise?

From the start of the year, markets have been optimistic because…

…Vaccines against COVID-19 are being implemented

…OPEC would curtail supply

…It’s a New Year

As silly as the last reason seems, given the history of the past year and the outlook for the future, it made sense for traders to lay on fresh long positions anticipating a recovery in oil prices (not necessarily demand, mind you). When the market was besieged by doubts, Saudi Arabia stepped in and volunteered to reduce its supply by a massive 2 million oil barrels per day giving cheer to the markets. This is, as we are fond of saying, the only market where a hoarder is cheered for his bullying tactics.

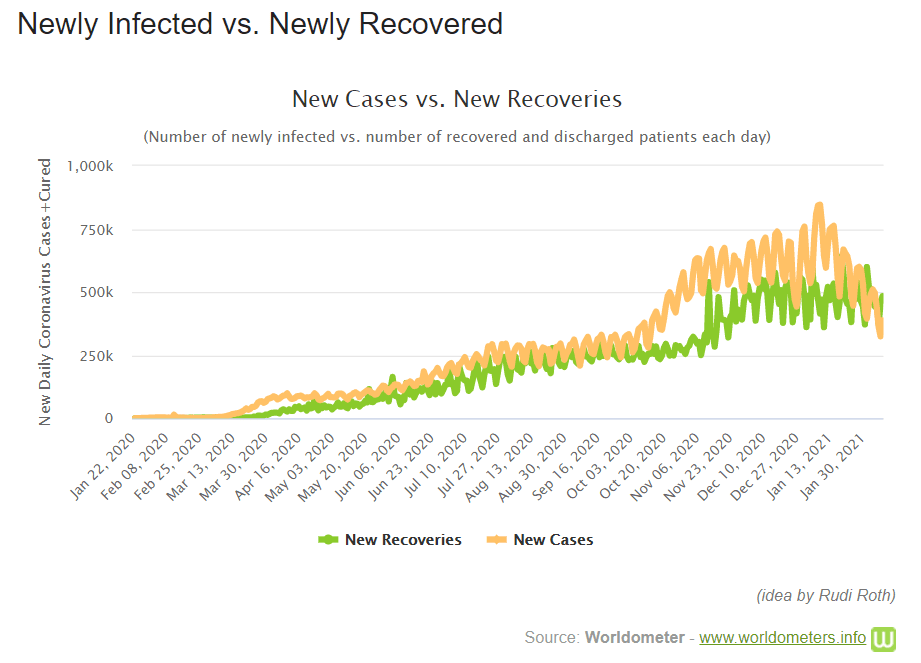

Over the last few days, however, one has also noticed a drop in the number of active cases affected by COVID 19. As can be seen by the graph, the incidence of new cases has clearly dropped and the number of recoveries seems fairly constant. This is undoubtedly a good sign and a cause for fresh optimism (albeit cautious) in the market.

SIGN UP for the IGNITE Blog to receive more content like this.

Where do we go?

In our last publication, we had stated that markets were at prices close to peak before the incidence of the coronavirus with demand nowhere close to those times. Today, markets are much higher than those times (prices have not been above $60 bbl ever since January 2020) and demand remains significantly lower.

Airline seat demand has recently been still reported as about 50% lower than last year, a worrisome number. The propensity or willingness to travel remains to be seen.

We initially anticipate a surge propelled largely by ‘cabin fever’ as people celebrate the lowering of lockdowns. Subsequently, it is highly probable that companies remember how effectively they were functioning during the lockdown without traveling.

The number of companies who have reduced their office space requirements is quite significant as they would be willing to have a higher fraction of their workforce working from home. This, in turn, has an impact (downwards) on motor fuel demand.

Client visits will return to higher levels, possibly higher than before as companies strive to re-bond with their customers.

The discretionary spenders on air travel, however, are in the senior citizen bracket and they are likely to take a long time to recover their enthusiasm for travel even after the clampdowns (ongoing and fresh ones as well) are lifted. Further, the impact of these higher prices on demand also needs to be considered.

On the supply side, these high prices can well increase supply from the US as also convince Saudi Arabia to back down at least a little from their proposed volume of cuts. We, therefore, see a retracement of these prices from here or slightly higher. The exact number can be left to technical analysts.

In conclusion, we have to say that we are heartened by the turn of events in 2021 and hope we do see a recovery. Having said that, we do hope that the recovery in oil prices does not overshoot to the extent where it derails the recovery process.

About the Author:

Sukrit Vijayakar is the founder of Trifecta Consultants and a veteran trader with over 25 years of trading experience. He delivers regular oil market commentary from his website and social media channels and has appeared on Asia TV as an authority on energy markets. Read his Oil Price Digest with regular market commentary. Sukrit provides industry training, energy software selection, and IT consultant services. Visit the Trifecta Consultants website.