Global oil price outlook, October 2020

Oil and gas markets are facing their third price collapse in the last 12 years. While markets have recovered from the price collapses of 2008 and 2015, we have to acknowledge that this price collapse is rather different from the previous two.

In each of the prior instances, prices started falling on their own and market perceptions about both supply and demand changed rapidly.

The usual parties are using the usual methods to bolster prices. While this has worked to some extent, how effective it will be in the short and medium-term continues to be a question to ponder.

Subscribe to the IGNITE Blog for more insights CLICK HERE

Price Action This Year To Date

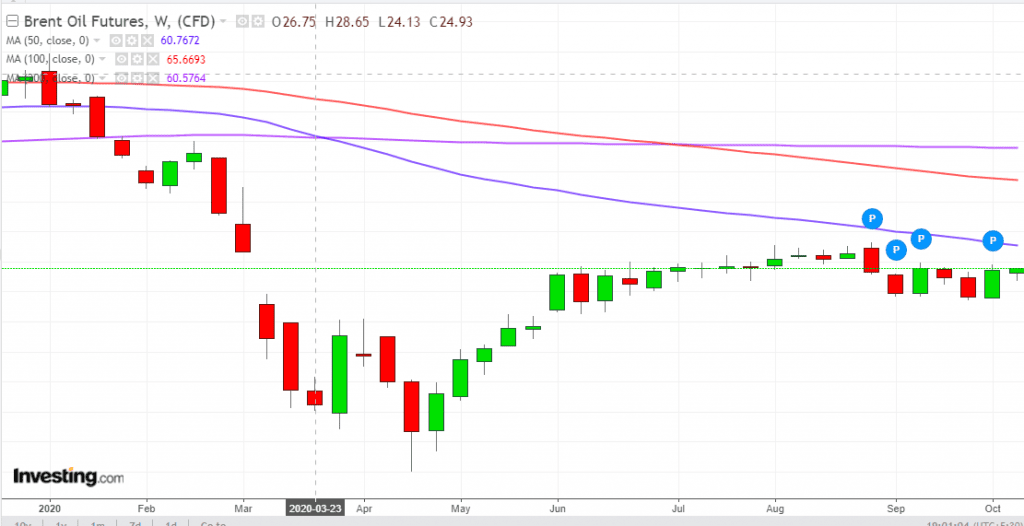

If we take a look at weekly price action, we can see that prices were seriously challenged even before the onset of COVID 19. This could have arguably been caused by the Saudis deciding to flood the markets with material.

The markets started getting jarred by COVID 19 towards the end of February with the infamous ‘negative settlement’ of WTI hitting the markets in the middle of April. Subsequently, Saudi Arabia decided to change tack and resorted to its time-tested methodology of supply cuts pulling the market up to the $40bbl mark.

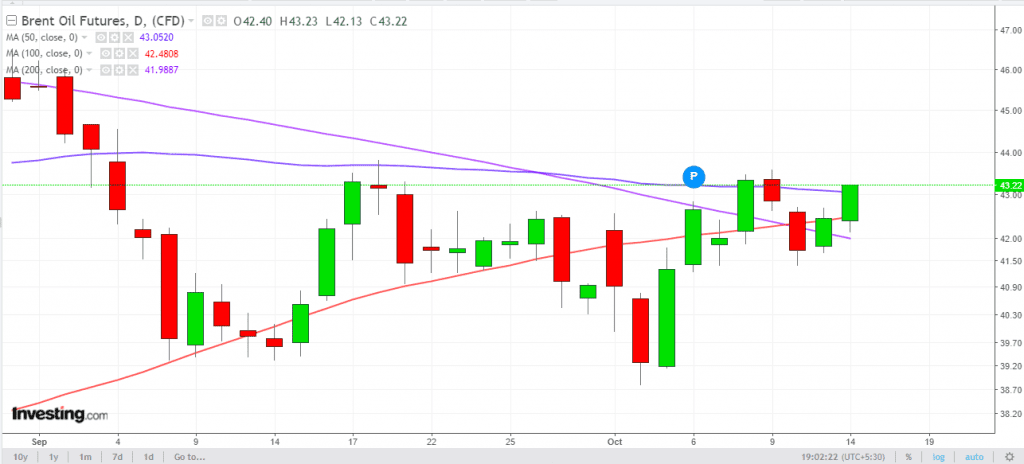

But it has struggled to stay above $40bbl consistently as can be seen from the daily chart below

From the start of September, concerns about the resurgence of COVID have been hammering prices and they appear to have been supported largely by storm activity and the promise by Saudi to extend cuts. Nevertheless, not even such promises are pushing Brent prices over $44bbl. Why?

Demand Versus Supply

Over the past several years, the only way prices have actually found support is by suppliers agreeing to cut down production. Having said that, at no time over the past several years were refiners forced to shut operations because of the unavailability of oil. The situation persists even today.

Prices have also been propped thanks to the lenient monetary policies being followed worldwide. The excess money available is parked in many global asset classes, including energy. This time around, any supply shortage of crude fails to worry because there is a severe demand shortfall for products. Further, the shutting down of production means that there is spare capacity available for the future should it be needed. Hence the specter of supply shortfall fails to scare people as much as it used to in the past.

The Changing Outlook for Product Demand

Over the past six months, the way the world has been doing business has been changing rapidly. The work-from-home culture that has been necessitated due to COVID has shown several benefits which will make a significant portion continue to stay in place even after the virus scare subsides. This will lead to reduced discretionary and even non-discretionary travel going forward.

The other aspect of discretionary travel, i.e. tourism is going to get hit even worse as the senior citizenry is going to be even more wary of travel than before. And all this presumes that COVID will recede soon.

How Long Does COVID Last?

We have been watching every attempt to emerge from lockdowns being met with fresh surges of the pandemic. We have been hearing stories of vaccines being made available all around the world. What is the truth? Are we anywhere near a cure?

The answer to that has to be a resounding NO. Even while the vaccine will be administered, it will be at least 6-12 months to evaluate the efficacy of each vaccine and even longer to establish a standard treatment for the disease. So, I don’t think we have any scope for immediate joy on that front.

Why, Then, Are Prices Supported?

We could go on analyzing further, but no matter what line we choose, the outlook for the immediate future looks bleak.

Basically, markets are holding on grimly to hope that demand will recover and we can go back to business as usual sooner rather than later. In that, they are helped by the extremely easy monetary policy being followed globally which suggests that stock markets are performing even better after 6 months of the COVID disaster than before.

Is It Really All That Gloomy?

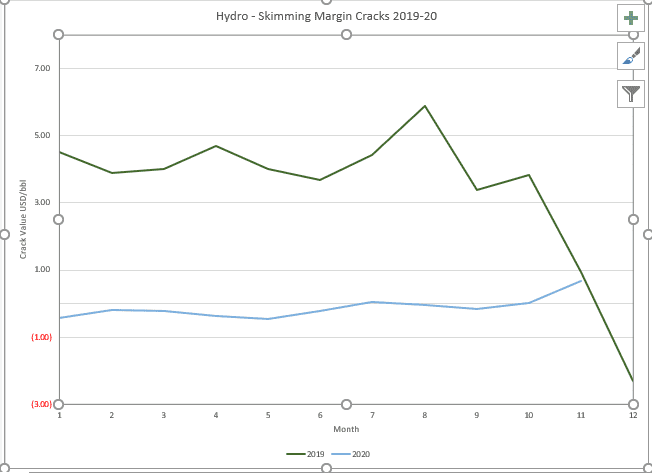

Notwithstanding the grim picture painted above, there are a few bright spots about the markets today. The first factor to note is that refining margins appear to be looking up and the forward curve for November seems to indicate a sharp recovery in refining margins. The major reason for this has been the petrochemical market has been holding firm and, in turn, has been keeping naphtha cracks at two-year highs.

The other factor is that people have got to come and face the virus and beat it. Because we cannot hide forever and hope to win. It may take a quarter or two for demand to bounce back from the present abysmal levels, but bounce back it will!

Subscribe to the IGNITE Blog for more insights CLICK HERE

About the Author:

Sukrit Vijayakar is the founder of Trifecta Consultants and a veteran trader with over 25 years of trading experience. He delivers regular oil market commentary from his website and social media channels and has appeared on Asia TV as an authority on energy markets. Sukrit provides industry training, energy software selection, and IT consultant services. Visit the Trifecta Consultants website.