10-minute check-in with Chief Risk Officer Mike Stark

Q&A: The technology climate for commodities trading systems and what’s next as oil markets make a recovery

In this segment of Industry Insights by Industry Leaders, brought to you by IGNITE CTRM, we get Chief Risk Officer Mike Stark’s thoughts on the current technology climate for commodities trading systems, and what may be coming down the pipeline as COVID dissipates and markets make a recovery.

Mike is an experienced Chief Risk Officer and business leader with over 25 years of experience in risk management from highly regulated trading environments for oil, gas, and water companies. Mike has successfully set up and led the risk and middle office functions at Peninsula Petroleum, PetroChina (Europe), and Chevron (Europe) trading organizations, in addition to his previous experience at Enron, Phibro, and Shell. Mike has onboarded ETRM / CTRM solutions, so he understands the challenges commodities companies face when selecting and running the software.

He is currently the founder of Stark Risk Consultancy which provides a variety of risk management services for commodities, utilities, financial services institutions, and other industry sectors.

Mike holds various professional qualifications in risk management and project management (CMIRM, ERP, CRICP, CRMA, PRINCE2), and is also a Certified Fellow (CFIRM) of the Institute of Risk Management (IRM).

SIGN UP for the IGNITE Blog to receive more content like this.

Q: How has your vision for technology and trade and risk management software changed in the past year due to COVID, and what has been the impact on energy companies, and your own clients?

A: Mike – It has been an extremely challenging year all-around and there are lots of lessons to learn from the pandemic. The impact on economies has been unprecedented which in turn has filtered down to companies and individuals. It has very quickly made us realize a lot of things in this fight or flight environment. One thing which particularly stood out was the swift action a majority of companies and individuals took when adapting to working from home and on reflection how seamless and successful this has been. From a technology standpoint, this has really emphasized the need to strengthen business continuity and disaster recovery plans which would include investing more in cloud-based technologies, platforms, and systems as securely and cost-effectively as possible.

Brigette – I would agree. Gartner has strengthened its forecasts for SaaS and cloud technology spend in 2021 and cites the pandemic for accelerated growth by CIOs to transform their infrastructures. It’s tough for any company to keep pace with fast-changing advances in tech, and it makes sense to leverage the performance and security big cloud providers deliver like Microsoft Azure. Azure has invested millions in keeping trading company data safe with strong security, fast performance, and disaster recovery built-in.

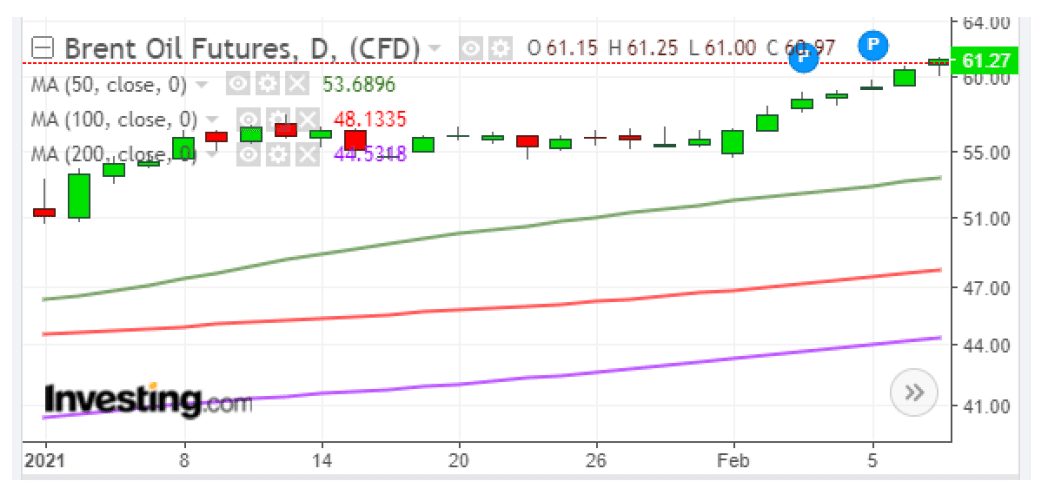

Q: Oil markets are surging higher and Goldman Sachs recently put out a forecast for oil to reach $75bbl this year. How do you think this outlook will change buying behavior for systems, services, hiring, office space?

A: Mike – There are clearly other considerations to take into account, but when there is a long-term bullish sentiment it generally equates to a healthier budget over time. With respect to systems, services and hiring, I’d expect a good response and support from companies as they strive to improve upon systems, processes, and capabilities they currently have in place in order to strengthen their decision making and speed at which they can make decisions, as well as supporting strategic objectives.

However, irrespective of forecasts, companies are still going to have to invest more and more in these areas where possible and look to other areas where they may be able to save money to finance these investments. A couple of obvious areas for cost-saving are office space; and, travel and entertainment. These are the generally the next highest areas for expenditure after salaries and wages. So, following on from my last answer, the successes from increased working from home has quickly demonstrated to a lot of companies their ability to reduce their physical office space and the number of physical office locations.

Q: How do you think it will impact business travel plans? You’re located in the UK, do you see any immediate changes?

A: Mike – As I briefly touched on, travel and entertainment are (generally) one of the top 3 expenses for companies. The pandemic has considerably reduced business travel but again it has demonstrated, with today’s technologies, just how easily we can stay connected. Clearly, not all business travel can be substituted for video conferences, nor would you want it to be, but it has highlighted an increasingly viable option to be considered when planning a business trip. So, do I see business travel picking up, absolutely, but do I see it picking up to pre-pandemic levels, no, at least not in the short to medium term and perhaps even longer than that.

Q: What do you think energy and commodities software (ETRM / CTRM) vendors should be thinking about as markets recover? Where do you see new opportunities for vendors as they align with pain points for your clients and prospective clients specifically?

A: Mike – This is a good question and a good time for ETRM vendors to be reaching out to existing clients and having these discussions. The two areas we covered already are, utilizing more cloud-based technologies and being compatible to support this; and, secondly taking into account the sheer economic hits to companies. You also need to take into account the increase in home working and the number of different locations individuals will be able to work from, as well as, how affordable ETRM systems need to become. I’ll talk about start-ups in a minute, but this is also relevant to the affordability of ETRM systems and having a much more realistic, supportive, and scalable pricing structure.

With respect to functionality, real-time integration with other systems is key for information in and information out. Being able to aggregate trading-related data into one place creating a single source of the truth, a system of records, data lakes, should be high on everyone’s agenda. Add to this the capability to automatically reconcile this data with the various external sources and to automate reporting and scheduling information will significantly improve the accuracy and timeliness of these processes. Also, within reason, the fewer times an individual needs to touch the data, generally the better the quality of that data.

Q: Markets were volatile in 2020 and many companies did well, while others didn’t. How do you address another volatile market in 2021 as a Head of Risk? What are the KPIs you keep in front of you?

A: Mike – It has been quite a year but generally volatility is well-received certainly for those organizations better equipped and prepared. Clearly having timely and accurate access to trade data, market prices and market news are just the basic requirements. Having good systems, controls, competent traders, clear strategies, experienced risk managers is also critical. Bringing this all together from a risk manager’s perspective and you can easily form some comprehensive dashboards of key risk indicators and key performance indicators that can be readily shared with the relevant stakeholders as close to real-time as possible. The main measures to be looking at are trading exposures against company trading delegations of authority, particularly ‘Stop Loss’ limits and ‘VaR’ limits, but it is also about having the robust processes and decision-making capabilities in place for escalating issues quickly and safely so that more timely and considered actions/reactions can be taken.

Q: How do you think COVID has impacted start-up trading companies who are trying to get off the ground or those who began trading just before COVID? What advice would you give them this year?

A: Mike – This is a very important consideration given the year we’ve just been through. COVID has clearly slowed down the ability for start-ups to grow and scale-up. The market has been even more unpredictable, oil prices going negative, but we also saw last year the scaling back by banks in commodity trade finance. This was mainly brought about by some bankruptcies and frauds in commodities and exacerbated by COVID. If you combine all this with lockdowns and travel restrictions, this has made it extremely difficult for start-ups to form new banking relationships and secure new credit lines or even to increase existing credit lines. In terms of advice, start-ups still need to invest wisely and timely in people, processes, and systems to create a strong foundation on which to grow sustainably. This, along with a solid business plan and strategy, is a prerequisite for succeeding. Demonstrating good governance, robust processes, experienced people and reliable systems is increasingly important to almost all external stakeholders, including banks, shareholders, and other investors. This coupled with strong leadership and clear objectives and strategies is a minimum requirement for securing credit – choosing the right banks is also important and having highly experienced trade finance support with strong working relationships with these banks is imperative.

Brigette – I would agree. And IGNITE has some young, start-up trading companies as clients who are doing well. Getting off of spreadsheets was key to being prepared for the situation we’re in, and for growing in the future.

In Conclusion

This concludes this segment of IGNITE’s Industry Insights by Industry Leaders. I want to thank Mike for participating and giving his respected views and also to everyone for listening to the video, and reading our blog.

To follow up with Mike, visit the Stark Risk Consultancy website at www.starkrisk.com.

If you would like to be featured here, shoot me a message on LinkedIn, and look for our next interview onIndustry Insights by Industry Leaders coming soon.

IGNITE CTRM is a modern, intuitive, high-performance SaaS in the cloud solution with affordable packages priced for start-up bulk liquids trading companies to large enterprises.

About The Author

Brigette Gebhard is an independent marketing specialist with more than 20 years of experience as a marketing executive in energy and commodities markets, and B2B SaaS cloud solutions.